Our Services

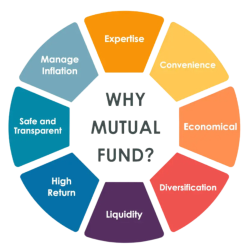

Mutual Funds

These are the most commonly used, well-regulated, time and cost-effective vehicle for investing in financial markets. We use mutual funds for meeting diverse needs across different time horizons.

Alternate Products

We selectively suggest PMS (Portfolio Management Services) and AIF (Alternate Investments Fund) as they possess a higher degree of customization as compared to mutual funds and is built on specialized investment strategies.

Health Insurance

A health insurance plan can be a solution to deal with the rising medical costs. It provides financial security by covering the costs related to treatment, hospitalisation, free health check-up, and pre and post hospitalisation expenses. Also, you can get tax relief on the premium under Section 80D.

Life Insurance

Why is life insurance important? Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

Tax Saving Schemes

You can save Upto 1.50 lac tax be investing in ELSS Funds Equity linked Saving schemes, these are Equity Mutual fund Schemes with the Lock in period of 3 years and Generate Best Returns.

Corporate Fd

These are savings accounts that pay a higher rate of interest than conventional savings accounts. It is a form of term deposit in which the investor deposits a big sum of money and receives interest at regular intervals until the maturity date. FDs are one-time investments, and the investor is not required to make monthly deposits.

Peer to Peer Lending

Finally, P2P lending provides a variety of benefits to both lenders and borrowers, including access to lower interest rates, increased lending opportunities, better returns for lenders, increased transparency and control, reduced default risk, increased financial system diversity, and convenience and accessibility